south dakota property tax rate

In addition cities in South. Custer County collects on average 097 of a propertys assessed.

Property Taxes By State Quicken Loans

South Dakota Property Tax Rates.

. Detailed South Dakota state income tax rates and brackets are available on this. If the county is at 100 of full and true value then the equalization. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would.

State Summary Tax Assessors. The states laws must be adhered to in the citys handling of taxation. Taxation of properties must.

This surpasses both the national average of 107 and the average in North Dakota which is 099. The median property tax in Custer County South Dakota is 1554 per year for a home worth the median value of 160700. The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities.

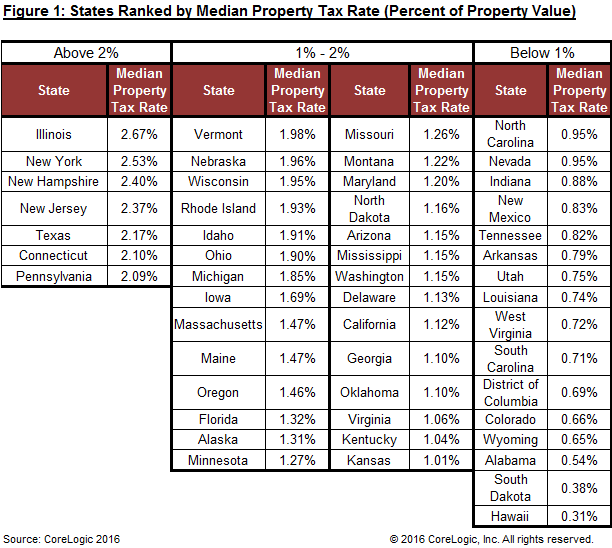

The effective average property tax rate in South Dakota is 122 higher than the national average of 107. South Dakotas state sales tax rate is 450. Across South Dakota the average effective property tax rate is 122.

South Dakota property taxes are based on your homes assessed. Then the property is equalized to 85 for property tax purposes. If you have any questions please contact the South Dakota Department of Revenue.

Lincoln County has the highest property tax rate in the state at 136. All property is to be assessed at full and true value. Brown County collects on average 144 of a propertys assessed.

The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. On average homeowners pay 125 of their home value every year in property taxes or 1250 for every 1000 in home value. South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent and an average combined state and local sales tax rate of 640 percent.

This data is based on a 5-year study of median property tax. South Dakota Sales Tax. Municipalities may impose a general municipal sales tax rate of up to 2.

You can look up your recent. 1-800-829-9188 option 2 Property Tax Division Email. They may also impose a 1 municipal gross.

Then the property is equalized to 85 for property tax purposes. The South Dakota Department of Revenue administers these taxes. The median property tax in Brown County South Dakota is 1661 per year for a home worth the median value of 115700.

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised. Furthermore taxpayers in South Dakota do not need to file a state tax return.

To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. The South Dakota income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

Maui Property Taxes Among Lowest In The Us

Which States Do Not Have Property Taxes In 2022 Ny Rent Own Sell

Tax Free States Pay No Income Tax In These 9 Tax Friendly States

North Dakota Officials Propose Flat Income Tax Rate Eliminating Individual Income Taxes For Most Taxpayers Inforum Fargo Moorhead And West Fargo News Weather And Sports

Property Tax South Dakota Department Of Revenue

What States Have The Lowest Property Tax Rates Quora

State Lodging Tax Requirements

The Most And Least Tax Friendly Us States

South Dakota Property Tax Calculator Smartasset

South Dakota Income Tax Calculator Smartasset

South Dakota Taxes Sd State Income Tax Calculator Community Tax

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

The 10 Best And 10 Worst States For Property Taxes

10 Best States For Lowest Taxes Moneygeek Com

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

How Much Florida Homeowners Pay In Property Taxes Each Year Florida Thecentersquare Com

Property Tax South Dakota Department Of Revenue

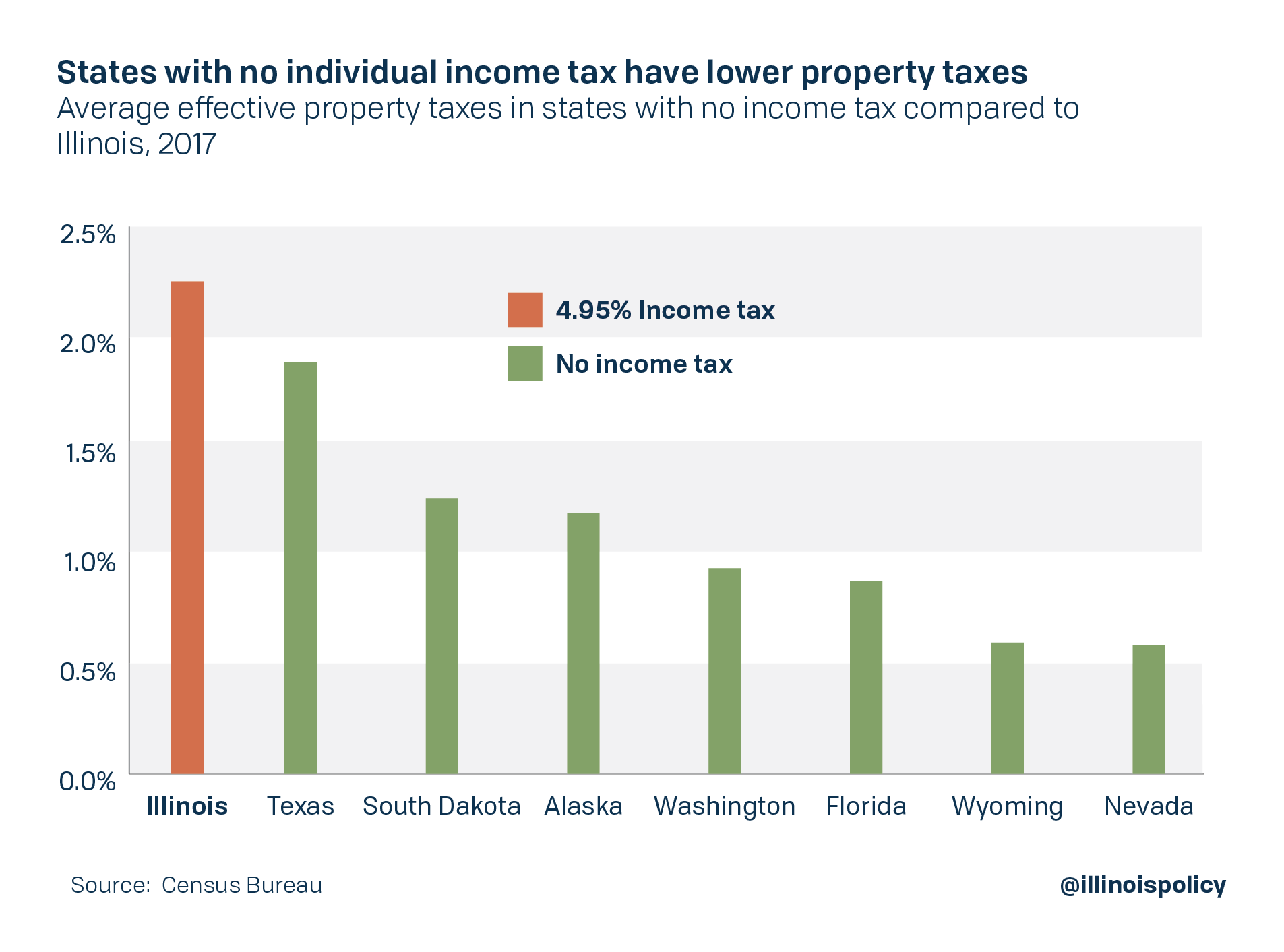

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running